Before we even consider what the right strategies are for you, the process of getting and keeping your financial house in order starts with collaborating and being clear on what assets you currently have, where everything is located and where the monies are flowing and why. We do this using visual flowcharts and our lifetime cash flow modelling. Then it’s a matter of creating order and having all financial matters and documents of importance stored and easily accessible in one secure vault or location. This ensures we can be confident we are across everything when assessing all aspects of your financial and life circumstances.

Key areas of focus here include:

As you approach the end of your working life, it is important that you plan for the next chapter, where there will still be bills to pay and a lifestyle to fund.

Retirement is a life-changing which will impact:

We work closely with you in the years approaching your retirement so that this transition has the least financial stress possible for you and your family. Having a clear plan for when you finish working, can go a long way towards a rewarding and happy next stage of life.

With so many superannuation providers and product choices, it can be difficult knowing where to begin. By taking an active interest in your super, and being engaged in the process, you can achieve so much more.

We make it easy for you to get engaged with your superannuation plan, by keeping it simple with strategies designed around tax-effective outcomes.

If terms like 'Salary Sacrifice', 'Deductible Contribution' and 'Transition to Retirement' make your head spin, it's time to partner with us to build your understanding and take control of your financial future.

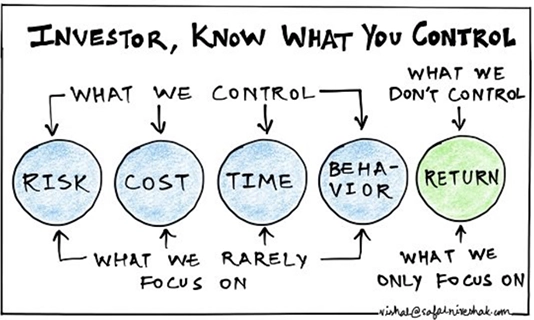

It's understandable to be overwhelmed by the number of possible ways to invest your money. However, it's important to remember that it's the number of available investment products that make it overwhelming and not the strategies that will set you on the path to your specific financial goals.

We explore factors like your purpose for building your wealth, when you need to access money, what you expect your return on investment to be over that time and how you might react to periods of volatility.

As specialists in investment strategies, we can tailor a solution that meets your specific needs and suggest products that will be best suited to your objectives.

The reality is that any financial plan is only as good as it’s weakest link. We at GHGPW believe that having a solid foundation is critical, starting with risk management. That is protecting you as much as is reasonably possible from the things that you don’t always see or expect. Also, from those aspects where ‘leakage’ can occur, or which can work against your best interests.

Core to this is the following areas we focus on as part of our forward planning process:

** Please note in all these key foundational areas, with your consent, we see our role as very much acting like your Personal Chief Financial Officer (CFO) and project manager overseeing all the main aspects to ensure follow through occurs. We don’t provide specific advice beyond identifying a potential need after taking into consideration ALL your broader circumstances and reasonably foreseeable risks. We will also provide some high-level education around the options to ensure you have the clarity you need. Further, where it is relevant, we will refer you to appropriate specialist professionals to ensure nothing important gets missed for your peace of mind.